Installation charges that are part of the sales price of tangible personal property certain digital property and taxable services sold at retail are generally subject to the general 4.

Can carpet cleaner charge tax in north carolina.

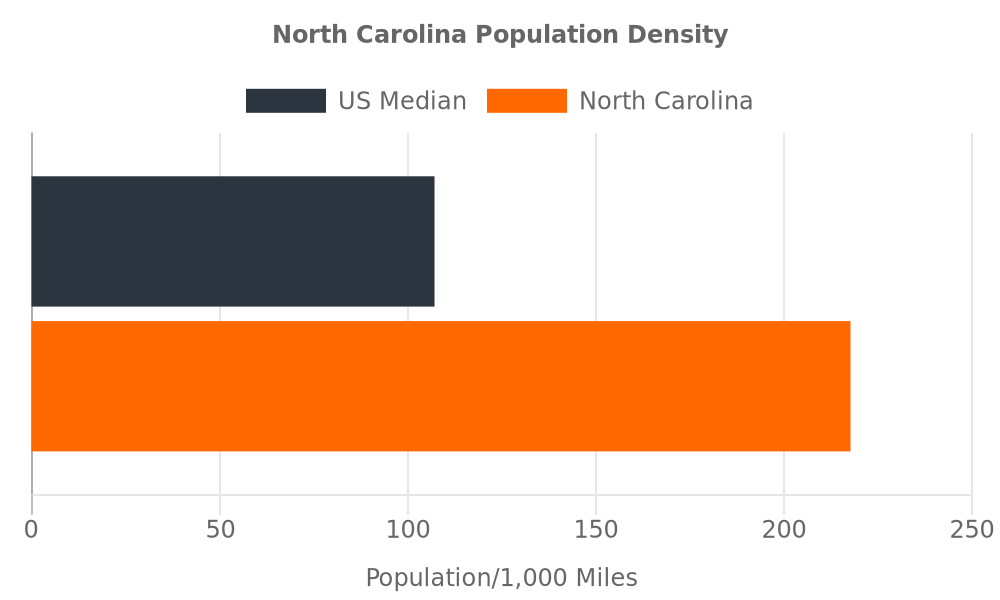

Taxes and north carolina gross domestic product statistical abstract 2012 part ii.

Summary of state general fund revenue collections.

Carpet cleaning businesses bill at least 30 cents per square foot and try to gross at least 100 an hour per job.

Security deposits are for the benefit and protection of the.

For example a service whose work includes creating or manufacturing a product it is very likely considered to be taxable and thus you would most likely have to pay sales tax on the service.

Can you please tell me if we should be charging sales tax on our invoices.

Statistical abstract 2012 part i.

If the carpet cleaning does not exceed a professional cleaner s normal rate and the carpet doesn t have any actual damage landlords should not charge a tenant for dirty carpets.

Under california sales tax rules cleaning or janitorial services are exempt from having to charge sales tax even when certain products cleaning products and supplies are used incidentally in connection with the services.

I assume you are a cleaning and janitorial service.

105 164 3 and are sourced in accordance with the sourcing principles set forth in n c.

In the state of north carolina services are not generally considered to be taxable.

How much profit can a carpet and upholstery cleaning business make.

With that figure if a single truck can stay in operation seven hours a workday it will gross about 700 per day for 240 workdays.

Sometimes a security deposit is called a damage deposit and is generally some amount of money that the landlord is able to hold on to if a rental property needs any cleaning or repairs in order to return the property to the condition it was in when the renter first moved in.

In other words landlords bear the cost of the routine carpet cleaning when a tenant moves out.

The following list which is not all inclusive provides examples of installation charges that are subject to the various tax rates imposed in north carolina.