Under the old tax law taxpayers could deduct approved costs associated with moving household goods and personal items along with the travel costs of moving to the new home excluding meals if they qualified.

California moving expense deduction 2019.

The undersigned certify that as of june 22 2019 the internet website of the franchise tax board is designed developed and maintained to be in compliance with california government code sections 7405 and 11135 and the web content accessibility guidelines 2 1 or a subsequent version june 22 2019 published by the web accessibility.

Sharon mccutcheon via unsplash with tax season in full swing it s time to take stock of all the income you ve brought in over the past year and tally up all of the expenses that might count as deductions to bring down your taxable income.

This interview will help you determine if you can deduct your moving expenses.

Most have adopted the federal suspension of the moving expense deduction exclusion but a few states remain in which employer payments for moving expenses are excludable.

Turns out he got canned in the summer of 2019 6 months in to the job and moved from ca back to illinois.

Moving expenses deduction for 2019 expenses.

Non military taxpayers prepare federal form 3903 moving expenses using california amounts.

Can i deduct moving expenses on my taxes in 2019.

I have a client who has approx 20 000 in taxable moving expenses paid for by his employer.

Fortunately in california for tax years prior to 2018 you may be able to deduct expenses related to relocating for work on both your state and federal income tax returns.

Although recent tax reforms have done away with moving expenses you re still able to claim these write offs for tax years 2017 and prior.

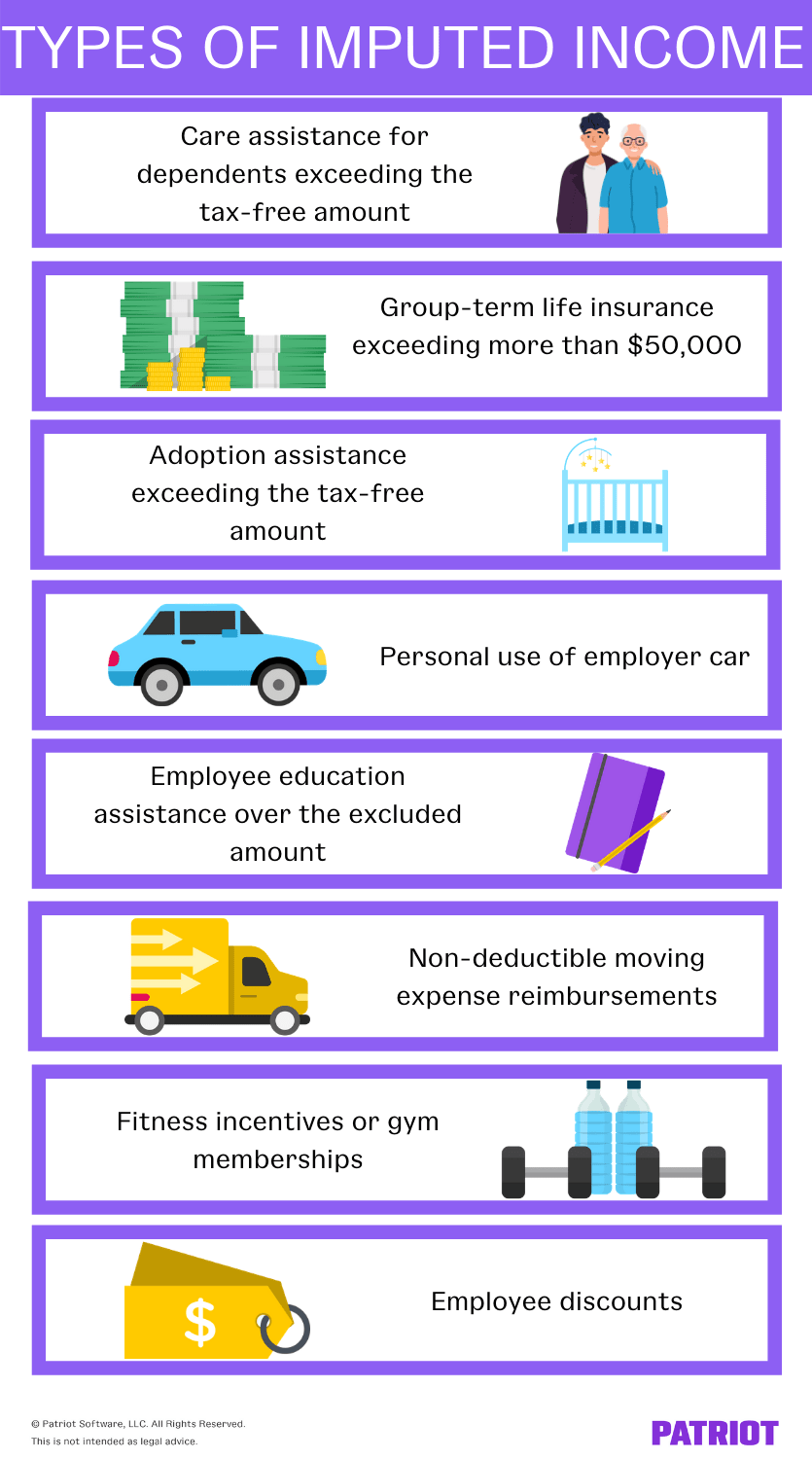

Types and amounts of moving expenses.

So long as the moving expenses are related to a job in ca and would otherwise meet the time and distance tests under 217 such expenses would be attributable to ca and deductible on the ca return.

He took a job in california in late 2018 and most of his moving expenses were paid in early 2019.

Does the moving expenses deduction apply to 2019 expenses.

Line 13 moving expenses california does not conform to federal law regarding the suspension of the deduction for moving expenses except for members of the armed forces on active duty.

With recent actions by the states of arizona and minnesota to conform their state taxes to the federal tax cuts and jobs act tcja enacted at the end of 2017 almost all states have now acted.

Citizens or resident aliens for the entire tax year for which they re inquiring.

Ca conforms to the irs based on a static date currently jan 1 2015 and does not therefore conform to tcja on moving expenses.